Student Loan Forgiveness and Higher Education Tax Credits

Student Loan Forgiveness Update Here are a few details of the proposed program:

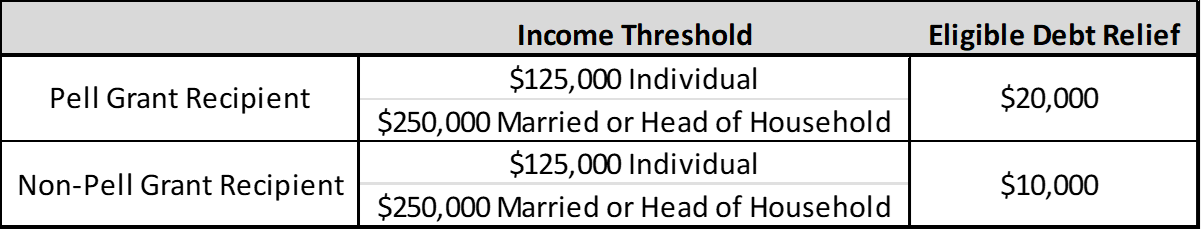

Who qualifies and for what level of forgiveness?

The plan applies to federal student loan borrowers and includes differing levels of forgiveness based on the type of loan and the borrower’s current income.

How do I apply?

According to the Federal Student Aid (FSA) website, nearly 8 million borrowers may be able to receive their debt forgiveness automatically due to the Department of Education (DOE) already having their income information. The Biden administration will also be launching an application in the next few weeks that will allow borrowers to provide their income information if they are unsure of their status with the DOE. Borrowers can sign up to be notified when the application goes live through the DOE website here.

Higher Education Tax Credits

Anyone pursuing higher education, including specialized job training and grad school, knows it can be pricey. Eligible taxpayers who paid higher education costs for themselves, their spouse or dependents in 2021 may be able to take advantage of two education tax credits. The American Opportunity Tax Credit and the Lifetime Learning Credit can help offset education costs by reducing the amount of tax they owe. If the American opportunity tax credit reduces the tax to zero, the taxpayer could receive a refund up to $1,000.

To be eligible to claim either of these credits, a taxpayer or a dependent must have received a Form 1098-T, Tuition Statement from an eligible educational institution. However, there are exceptions for some students. To claim either credit, taxpayers must complete Form 8863, Education Credits, and file it with their tax return.

Here are some key things taxpayers should know about each of these credits:

The American Opportunity Tax Credit is:

- Worth a maximum benefit of up to $2,500 per eligible student

- Only available for the first four years at a post-secondary or vocational school

- For students pursuing a degree or other recognized education credential

- Partially refundable; Taxpayers could get up to $1,000 back

The Lifetime Learning Credit is:

- Worth a maximum benefit of up to $2,000 per tax return, per year, no matter how many students qualify

- Available for all years of postsecondary education and for courses to acquire or improve job skills

- Available for an unlimited number of tax years

Taxpayers can use the Interactive Tax Assistant tool on IRS.gov to figure out if they’re eligible for either of these credits.