Does the Error by the MN Department of Revenue Affect Your Tax Filings?

The MN Department of Revenue discovered an error in the instructions for tax years 2019 and 2020 that they are now attempting to correct. With the release of the worksheet for calculating the standard deduction limitations in September 2021, the MN Department of Revenue mistakenly lowered the standard deduction by 20% when it should have been lowered by 80%. Since this error occurred too late for tax software developers to update the necessary forms before the October 15th, 2021 deadline, potential filing errors occurred.

What Does This Mean?

Basically, the MN Department of Revenue is now reviewing about 45,000 individual income tax returns and issuing adjustment letters to those affected by the error. It is important to note that if you receive a letter, there will be no interest or penalties if the balance due is paid within 60 days of the date of the letter. Also, the error only affects MN income tax filings and does not pertain to federal tax filings.

Am I Affected?

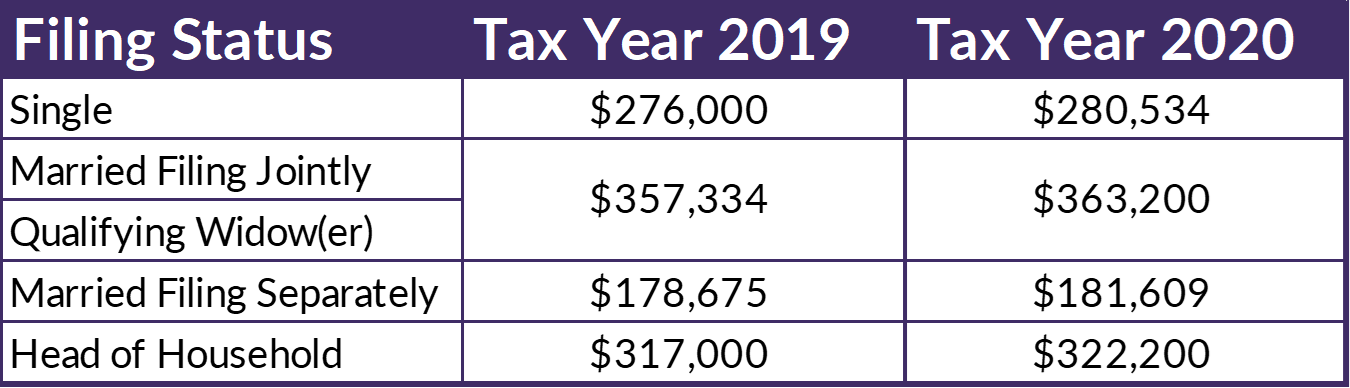

If your federal adjusted gross income exceeds these thresholds, this update may impact you.

What Should I Do?

If you received a letter and have any questions, please reach out to your SDK CPA for guidance. Our team is familiar with the error and can walk you through any needed steps to correct the Department of Revenue’s error. Reach out to us today at 612-332-5500 or info@sdkcpa.com.