IRS Increases Standard Mileage Rate

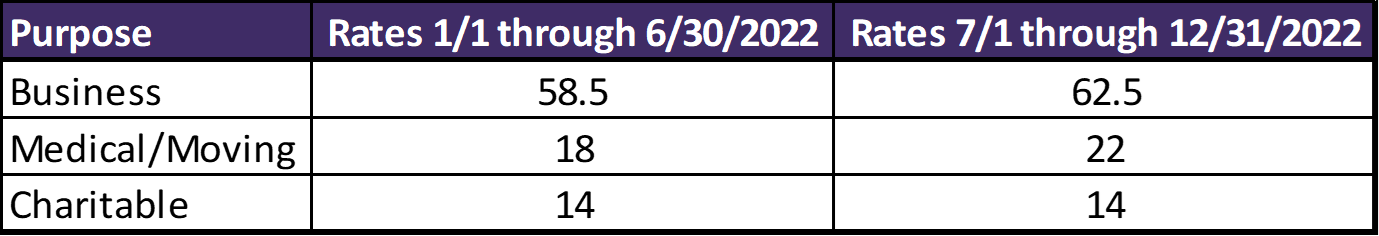

In recognition of the increased cost of gasoline, the Internal Revenue Service (IRS) has made a change to the standard mileage rate. The rate change will go into effect on July 1st, 2022 and run through the remainder of the year. See below for the updated rates and more information on the change.

“The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices,” said IRS Commissioner Chuck Rettig. “We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.”

For more information and legal guidance on the change, please see the official announcement here. If you have any questions about your business or tax obligations, please reach out to the team at SDK to help you through the changes. You can connect with us by phone at 612-332-5500 or through email at info@sdkcpa.com.