Save Your School Supply Receipts and Save on Your Taxes

The Minnesota Department of Revenue reminds you that many school supply purchases may qualify for valuable K-12 tax benefits on your 2022 Minnesota income tax return. Remember to save your school supply receipts.

“Summer is in full swing, but we know it goes all too fast here in Minnesota,” said Revenue Commissioner Robert Doty. “When you’re out ‘back to school’ shopping, be sure to save your receipts so you can claim the K-12 Education Credit or Subtraction. This will help save money when it comes time to file taxes next year.”

What K-12 tax benefits does Minnesota offer?

Two Minnesota tax benefits help families pay their child’s education expenses: The K-12 Education Credit and the K-12 Education Subtraction.

Both benefits reduce your state tax and could provide you a larger refund when filing your state income tax return. Last year, more than 19,000 families received the K-12 Education Credit and saved an average of $261. Nearly 130,000 families received the K-12 Education Subtraction with an average subtraction of $1,207.

Do I qualify for these tax benefits?

To qualify for either the credit or subtraction, both of these must be true:

- You have a qualifying child attending kindergarten through 12th grade at a public, private, or qualified home school

- You purchased qualified education-related expenses in 2022 to assist with the child’s education

However, separate income requirements apply for the credit and subtraction:

- K-12 Education Subtraction: There are no income limits for the subtraction.

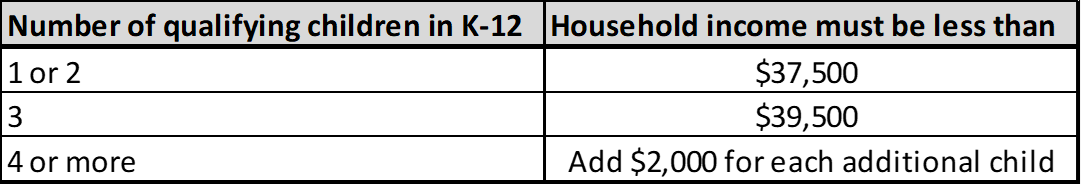

- K-12 Education Credit: Your household income (taxable and nontaxable income) must be below the levels shown in the table. You must file a Minnesota return to claim the credit, even if you are not required to file. If you are married, you and your spouse must file a joint return to qualify.

What education-related expenses qualify?

Many expenses for educational instruction or materials may qualify, including:

- Paper and notebooks

- Pens and pencils

- Nonreligious textbooks

- Rental or purchases of educational equipment, including musical instruments

- Computer hardware (including hotspots, modems, and routers) and educational software (up to $200 for the subtraction and $200 for the credit)

- After-school tutoring and educational summer camps taught by a qualified instructor

Internet service or access fees do not qualify.